Investing in Bitcoin and other cryptocurrencies in the UAE has become more efficient, thanks to exchanges regulated by the Abu Dhabi Global Markets (ADGM).

These platforms enable fast and safe AED deposits via bank transfers or credit card transactions, promoting safe investments in the growing digital asset ecosystem.

Best 5 Cryptocurrency Exchanges in the UAE

Our team has identified the top 5 digital currency exchanges in the UAE. Each offers user-friendly interfaces, diverse trading options, and reasonable fees.

- Rain: Best Overall Exchange in UAE

- Bybit: Best Platform for Derivatives Traders

- Kraken: Top Choice for Asset Security

- Binance: Best for Institutions and Companies

- OKX: Best Beginner-Friendly Trading Platform

Our Exchange Ranking Methodology

Evaluating the wide array of cryptocurrency trading platforms in the UAE can be challenging. Our dedicated team has carefully analyzed the leading options to identify the top 5 for Emirati investors. We conducted thorough reviews, showcasing their strengths and identifying potential improvements. Here’s an overview of the five best digital asset exchanges in the UAE.

1. Rain

Rain is the best overall cryptocurrency exchange in the UAE, based in Dubai and fully licensed by the Abu Dhabi Global Market (ADGM). It is also licensed across the Middle East, including by the Central Bank of Bahrain, making it the most trusted exchange in the region.

Rain charges 0% fees and offers industry-leading spreads, providing exceptional value to traders. The platform supports over 70 cryptocurrencies, catering to diverse trading needs. Its user-friendly interface, robust security measures, and comprehensive customer support ensure a seamless trading experience for both beginners and experienced traders.

- Minimum Deposit: 200 AED for the first deposit.

- Supported Assets: Over 70 cryptocurrencies.

- Regulation: Fully licensed by ADGM and the Central Bank of Bahrain.

- Fees: 0% fees with industry-leading spreads.

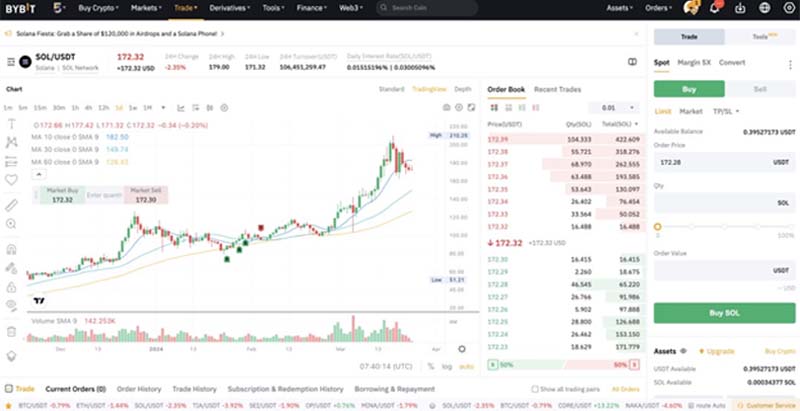

2. Bybit

Bybit stands out in the UAE’s crypto market with its extensive range of cryptocurrencies. Traders can access over 1000 tokens, allowing for diverse portfolios and new market opportunities. Advanced trading tools and real-time analytics enhance the trading experience, helping investors make informed decisions.

Bybit offers multiple order types, including spot, futures, and options trading with up to 25x leverage. Users can buy, sell, stake, lend, and borrow crypto, using BTC as collateral. Bybit also features a robust NFT marketplace and a crypto card.

- Minimum Deposit: 80 AED for the first deposit.

- Supported Assets: Over 1000 cryptocurrencies.

- Regulation: Registered in the UAE.

- Fees: 1% for spot trading, 0.01% for maker orders, and 0.06% for taker orders on futures markets. AED deposits and withdrawals are free.

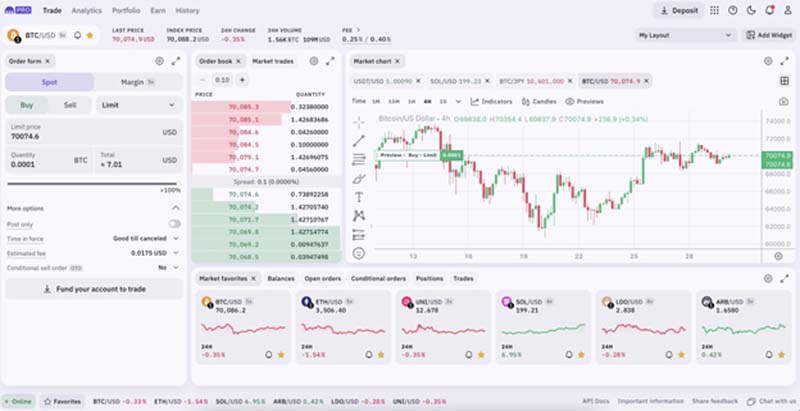

3. Kraken

Kraken is known in the UAE for its strong focus on asset transparency. The platform provides detailed and daily audits of the coins in its custody, transaction histories, and asset health, ensuring traders are well-informed about their investments. This transparency fosters trust and reliability.

Kraken’s robust security protocols protect user assets and personal information. With licensing in over 190 countries, Kraken is one of the most regulated and trusted exchanges globally. Its commitment to security ensures that user funds are always safeguarded.

- Minimum Deposit: 200 AED for the first deposit.

- Supported Assets: Over 200 cryptocurrencies.

- Regulation: Regulated by the ADGM.

- Fees: 26% for spot trading; maker/taker rebate of 0.02%/0.05%.

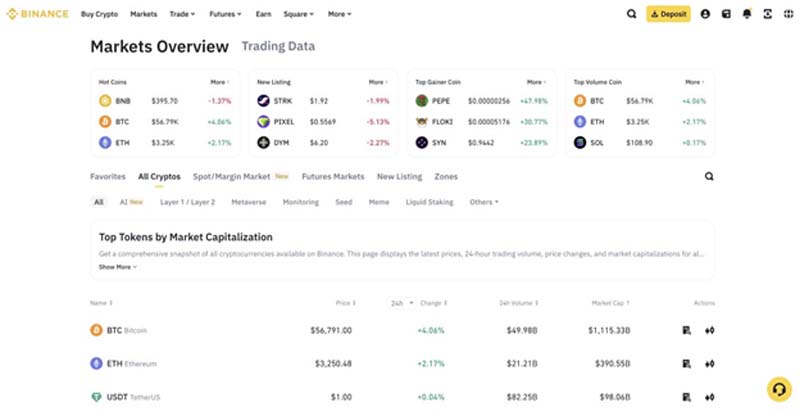

4. Binance

Binance is the leading platform for institutions and companies in the UAE seeking to engage in cryptocurrency trading. It offers a robust suite of tools tailored for institutional use, including over-the-counter (OTC) trading, sub-accounts, and dedicated support channels. High liquidity and comprehensive API solutions make Binance an excellent choice for businesses integrating cryptocurrency into their operations.

As the world’s largest exchange, Binance serves over 180 million users in more than 100 countries, including the UAE. It supports over 40 languages, including English and Arabic, and offers multiple AED deposit options, low fees, live multilingual customer support, and unique features like copy trading services.

- Minimum Deposit: 150 AED for the first deposit.

- Supported Assets: Over 350 cryptocurrencies.

- Regulation: Registered with the ADGM.

- Fees: 1% for spot markets, 0.02% for maker orders, and 0.06% for taker orders on futures markets. Deposit and withdrawal fees vary by method.

5. OKX

OKX is ideal for new traders in the UAE, offering a user-friendly platform with an intuitive interface and extensive educational resources. With 24/7 customer support, beginners can easily understand and navigate the crypto landscape. The platform also provides demo trading, allowing users to practice without financial risk, building confidence before live trading.

OKX users can explore decentralized finance (DeFi) through its integrated decentralized exchange, which supports the OKX chain and offers a native wallet, token, and various DeFi yield farming options.

- Minimum Deposit: 200 AED for the first deposit.

- Supported Assets: Over 400 cryptocurrencies.

- Regulation: Not registered in the UAE.

- Fees: 3% for spot trading, 0.02% for maker orders, and 0.05% for taker orders.

Is Cryptocurrency Regulated in the UAE?

The UAE has a progressive approach to cryptocurrency regulation, setting it apart from more restrictive nations. The Abu Dhabi Global Market (ADGM) is the primary authority overseeing digital assets in the country. While cryptocurrencies are not recognized as legal tender, the UAE is actively exploring their potential in the financial ecosystem.

Regulatory bodies are working to understand and integrate digital asset transactions, positioning the UAE as a leader in crypto regulation within the Middle East and North Africa (MENA) region. The UAE’s attitude towards digital currencies is increasingly positive, reflecting the global trend of growing adoption.

Cryptocurrency Tax in the UAE

In the UAE, the tax landscape for cryptocurrency activities has garnered attention due to the rising importance of digital assets. The UAE Ministry of Finance has provided guidelines on tax responsibilities for individuals and businesses involved in crypto transactions. Personal use of cryptocurrency does not incur VAT (Value Added Tax).

For personal trading, capital gains tax considerations are relevant. Although the UAE generally does not tax personal income, any capital gains from crypto trading are included in your overall income. Capital losses can offset gains but cannot be applied against other income sources. This nuanced approach reflects the UAE’s evolving stance on digital asset taxation.

Final Thoughts

In conclusion, the UAE is emerging as a prominent hub for cryptocurrency trading, driven by strong regulatory oversight from the Abu Dhabi Global Market (ADGM). The top five exchanges, Rain, Bybit, Kraken, Binance, and OKX, provide a secure and user-friendly environment for Emiratis to invest in digital assets.

Though personal income remains tax-free, it’s essential for traders to stay informed about capital gains and losses related to crypto transactions. This careful balance of regulation and opportunity underscores the UAE’s forward-thinking approach to digital finance.