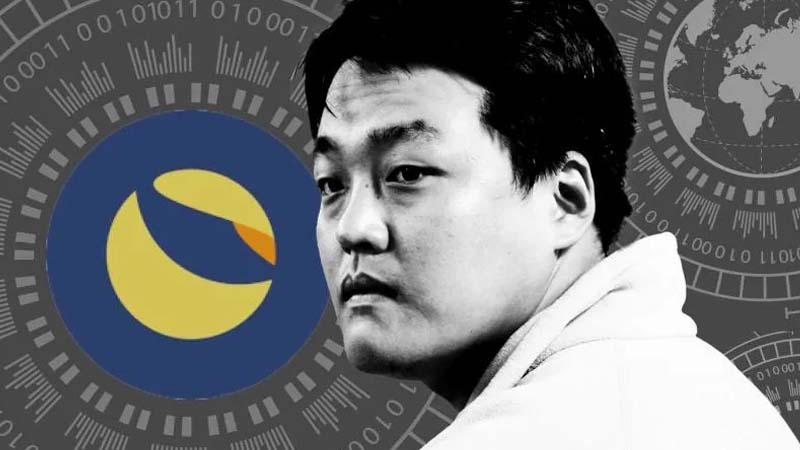

As the high-profile trial of Terraform Labs and its founder Do Kwon nears its conclusion, attorneys are set to deliver their final arguments on Friday. The trial, a pivotal moment in the realm of cryptocurrency regulation, sees the U.S. Securities and Exchange Commission (SEC) accusing Terraform and Kwon of misleading investors before the dramatic collapse of their stablecoin in 2022.

Central to the SEC’s allegations is the claim that Terraform Labs, a Singapore-based company, and its founder falsely represented the stability of TerraUSD, a stablecoin pegged to maintain a value of $1. Further accusations involve misleading statements regarding the utilization of Terraform’s blockchain technology in a widely-used Korean mobile payment application, Chai.

The defense team for Terraform and Kwon has countered these allegations, arguing that the SEC has misrepresented the facts and relied on testimony from witnesses incentivized by potential whistleblower rewards. The defense’s stance focuses on contesting the SEC’s interpretation of the events and statements surrounding the TerraUSD and Luna cryptocurrency debacle.

The significance of this case lies in its massive financial impact, with the SEC estimating investor losses exceeding $40 billion across both TerraUSD and Luna. The instability and subsequent collapse of these tokens not only affected individual investors but also led to a ripple effect that destabilized other cryptocurrencies, including Bitcoin, and precipitated a wave of bankruptcy filings across the crypto industry in 2022.

One of the critical points of contention is the SEC’s assertion that Kwon and Terraform clandestinely orchestrated a third-party purchase of substantial amounts of TerraUSD to artificially maintain its price during a previous dip in May 2021. The SEC contends that Kwon misleadingly attributed this recovery to TerraUSD’s algorithmic stability.

Do Kwon, who faces criminal charges in both the U.S. and South Korea, has been notably absent from the trial following his arrest in Montenegro in March 2023. As the trial draws to a close, the implications of the jury’s decision will likely extend far beyond this specific case, potentially shaping the future regulatory landscape of the volatile and evolving world of cryptocurrencies.